Legal Entity for Limited Time

Having a business name does not separate the business entity from the owner, which means that the owner of the business is responsible and liable for all debts incurred by the business. If the business acquires debts, the creditors can go after the owner’s personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business.

The term is also often used colloquially (but not by lawyers or by public officials) to refer to a company. A company, on the other hand, is a separate legal entity and provides for limited liability, as well as corporate tax rates. A company structure is more complicated and expensive to set up, but offers more protection and benefits for the owner.

Business entity from the owner, which means that the owner of the business is responsible and liable for all debts incurred by the business. If the business acquires debts, the creditors can go after the owner’s personal possessions. A business structure does not allow for corporate tax rates. The proprietor is personally taxed on all income from the business.

Colloquially (but not by lawyers or by public officials) to refer to a company. A company, on the other hand, is a separate legal entity and provides for limited liability, as well as corporate tax rates. A company structure is more complicated and expensive to set up,

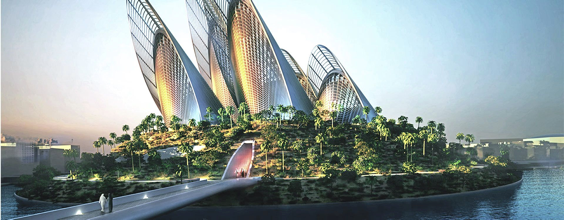

Project Information

- Client: Robert

- Project Value: USA

- Architect: Alex